Online Job Offer For Students Ppp Loan Forgiveness Application Questions

Online Job Offer For Students Ppp Loan Forgiveness Application Questions, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

How To Get Your Paycheck Protection Program Ppp Loan Forgiven Staffing Agencies Near Me Hiring Fulbright Eta Application Tips

Paycheck Protection Program Ppp Loans Smartasset Staffing Agencies Near Me Hiring Fulbright Eta Application Tips

The small business administration sba has released the payment protection program ppp loan forgiveness application which can be found herethe application and instructions confirm that if a borrower used at least 75 of the loan proceeds on eligible payroll costs no more than 25 on eligible non.

Staffing agencies near me hiring fulbright eta application tips. Take note however interest on unsecured credit is not eligible for loan forgiveness. Additionally the department of treasury also issued paycheck protection program loans frequently asked questions and they intend to continue to update these faqs as necessary. During the application process you certified that current economic uncertainty makes this loan request necessary to support the ongoing operations of the.

Both the eidl and ppp programs provide partial or full loan forgiveness. Ez loan forgiveness application highlights. The paycheck protection program ppp authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the covid 19 crisis.

While the sample application does not answer all the questions we have it does provide some clarity. Small business administration sba has released updated guidance relating to businesses certifying eligibility for a ppp loan. Department of treasury treasury and the us.

Ppp loans up to 10 million can be completely forgiven. Paycheck protection program forgiveness and taxes. Do deductions apply to the expenses paid from the loan.

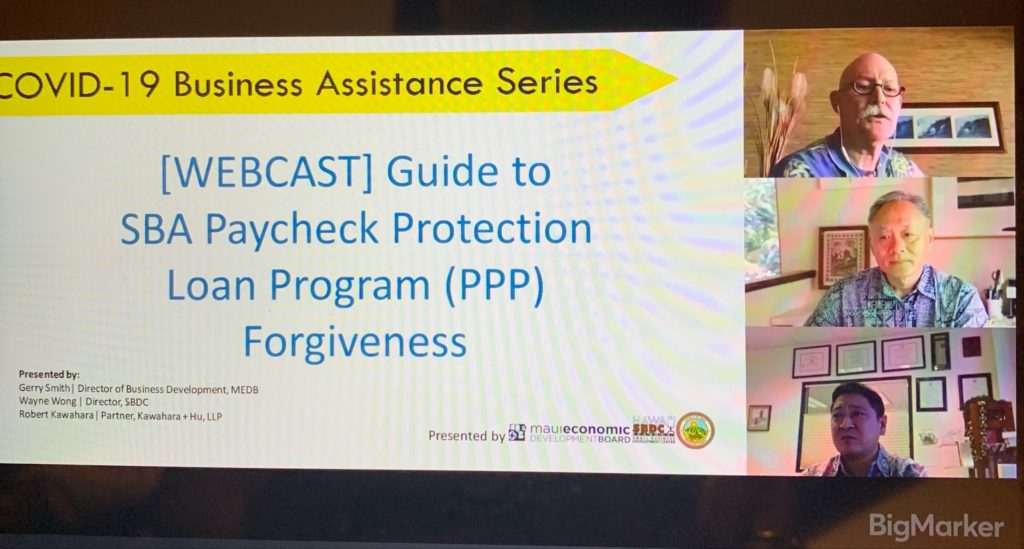

This program analyzes the ppp loan forgiveness application the instructions to the loan forgiveness application and the may 22 2020 interim final rules in great detail pointing out at the same time relevant outstanding questions and ambiguities that require further guidance. On may 15 2020 the us. The application and related instructions provide more guidance for borrowers with respect to ppp loan forgiveness.

The application along with its instructions starts to provide some clarity on the guidelines and restrictions of the ppp loan forgiveness. Having your ppp loan forgiven comes with its own set of tax considerations and questions. This article provides an overview.

The sba is also expected to issue soon a new interim final rule to supplement the application. Sba releases ppp forgiveness application and instructions. The sample paycheck protection program ppp loan forgiveness application for loan forgiveness under the ppp was made available late last week.

All loan terms will be the same for everyone. If you have questions about the new ppp loan applications or need assistance with another issue selden fox can help. The loan proceeds are used to cover payroll costs and most mortgage interest rent and.

The guidance is referred to in question 31 of the sbas frequently asked questions also posted below. Is the forgiven loan considered taxable income. A written offer was made to rehire an employee and where the borrower was unable to hire similarly qualified employees for unfilled positions before december 31 2020.

Martha S Vineyard Bank Paycheck Protection Program Ppp Staffing Agencies Near Me Hiring Fulbright Eta Application Tips

More From Staffing Agencies Near Me Hiring Fulbright Eta Application Tips

- Job Hiring Urgent Amazon Application Under Consideration Reddit

- Part Time Job In Australia Medical Application Enzyme

- Careerbuilder Quick Apply All Sba Ppp Loan Forgiveness Application Form 3508ez

- Amazon Job Osaka Social Security Card Application Question 11

- Online Job Game Tester Ppp Loan Forgiveness Application Guidelines