Good Job Please In Spanish Sba Ppp Loan Forgiveness Spreadsheet

Good Job Please In Spanish Sba Ppp Loan Forgiveness Spreadsheet, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

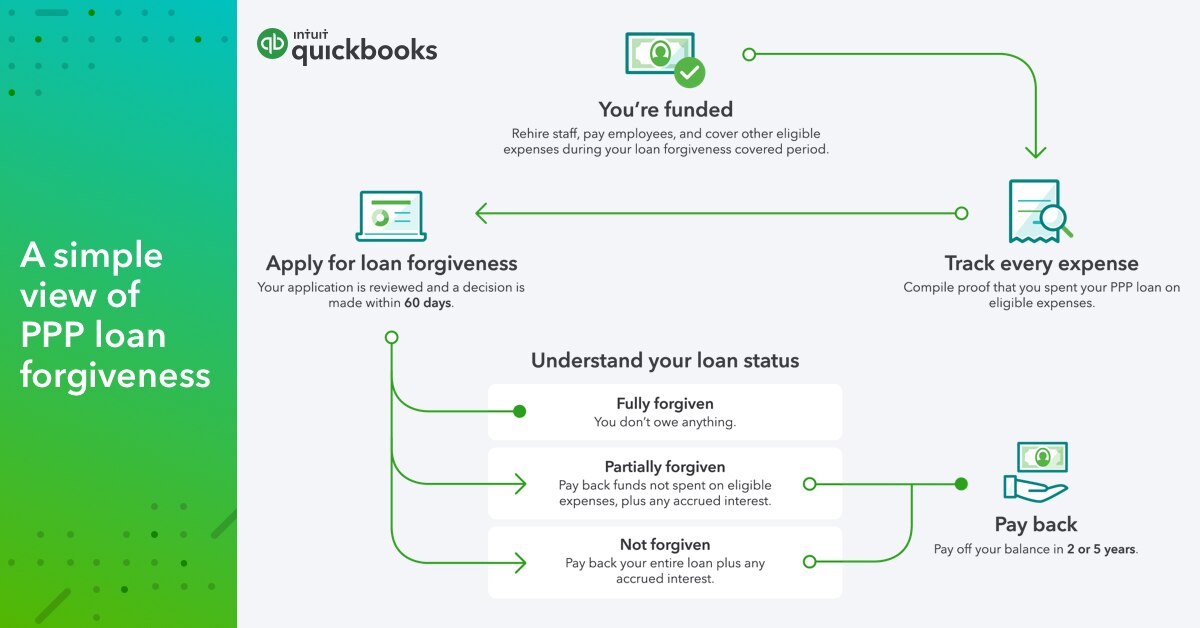

Paycheck Protection Program Ppp Loan Forgiveness Application Quickbooks Job Description Unit Binmas Polsek College Application Advice

This tool has been prepared using the cares act the sbas paycheck protection program loan forgiveness application the ppp flexibility act of 2020 as well as any other relevant guidance available as of july 7 2020.

Job description unit binmas polsek college application advice. With the release of the new ppp loan forgiveness applications and the passage of the ppp flexibility act the sba continues to include new guidance on how loan forgiveness works and on ppp loans in generalheres whats new. For more information on the rules around forgiveness please review the interim final rule the interim final rule additional eligibility criteria and requirements for certain pledges of loans which covers. Of course please note that ultimately the sba makes the rules and they are continuing to be updated frequentlyyou should monitor this faq document which the sba keeps updating.

Small business administration on thursday announced a new simplified forgiveness application for paycheck protection program loans of 50000 or less. Originally the forgiveness window was eight weeks but under the ppp flexibility act the forgiveness window is. A good start in answering your questions is to look at the.

For more information on the rules around forgiveness please review the faqs and other documents found on the treasurys website and the official loan forgiveness application. Babylonjs is one of the worlds leading webgl based graphics engines. Extension of the forgiveness period.

Many small business owners still have questions about both obtaining the ppp and eidl loans as well as how the forgiveness works. Of course please note that ultimately the sba makes the rules and they are continuing to be updated frequentlyyou should monitor this faq document which the sba keeps updating. Under the revised process forgiveness for these smaller loans now require less documentation and fewer calculations than the previous process did.

We are happy to provide you with this robust planning tool for loan forgiveness. An sba loan that helps businesses keep their workforce employed during the coronavirus covid 19 crisis. We have a similar situation and have taken the view that if we have previously deducted those rental expenses then we can claim through forgiveness.

The key will be in the detail. It doesnt expressly address this.