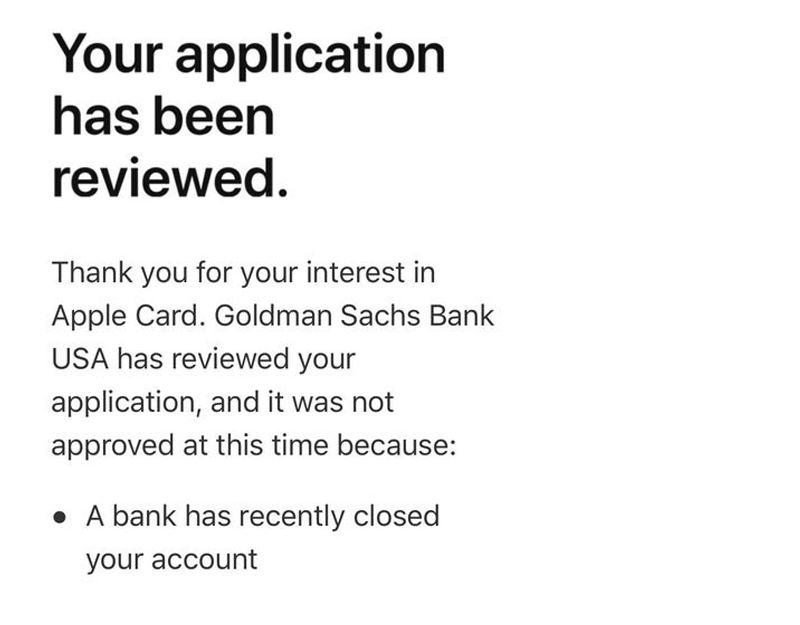

Job Search Application Credit Card Application Declined

Job Search Application Credit Card Application Declined, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

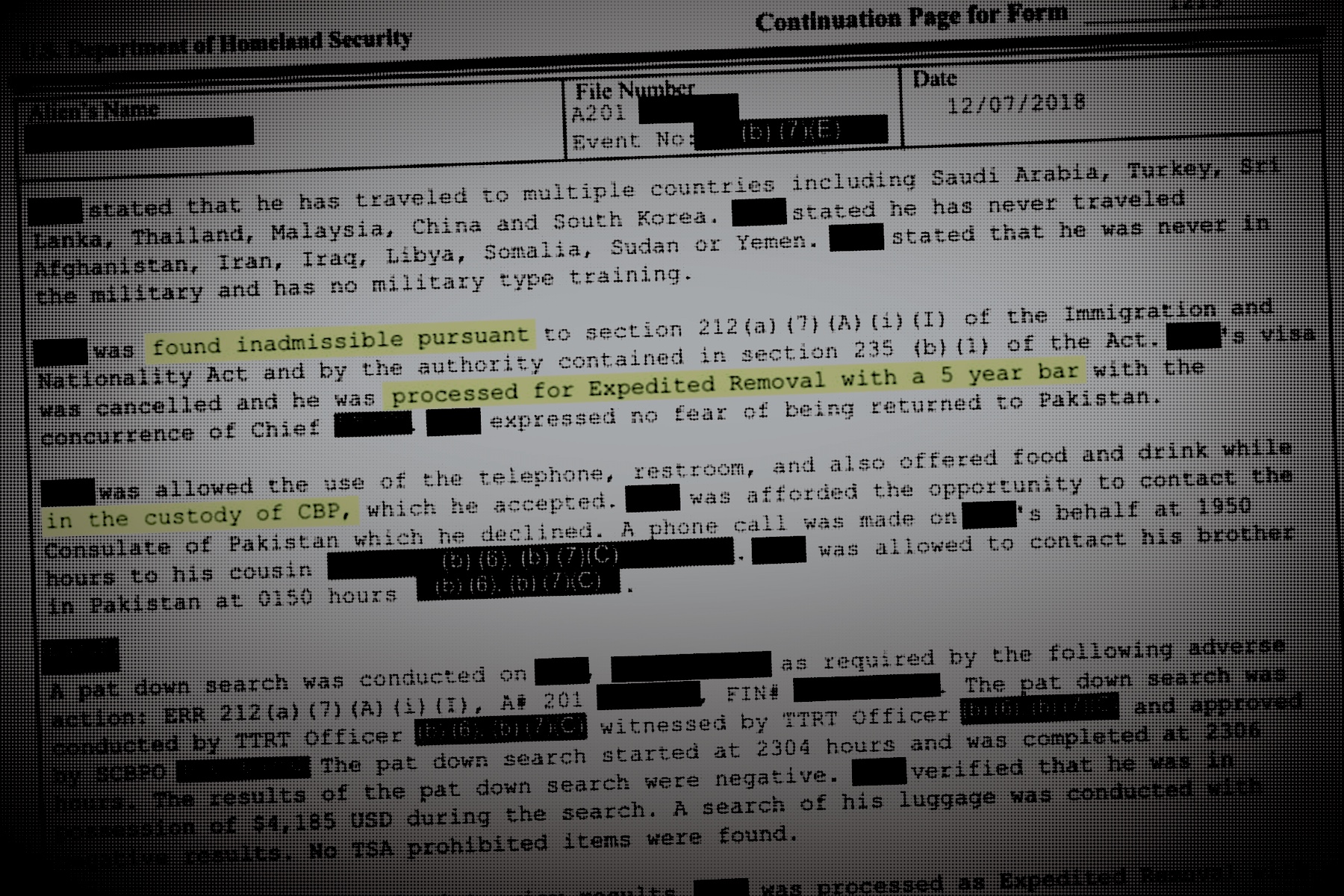

Another Us Visa Holder Was Denied Entry Over Someone Else S Messages Techcrunch Job Opportunities Gender Inequality Fafsa Application And Verification Guide 2019

Discover does not reconsider credit card applications according to customer service representatives.

Job opportunities gender inequality fafsa application and verification guide 2019. If your card gets declined call your credit card company immediately. Bank credit card application at 800 947 1444. You check your credit reports at least once a year and perhaps use a free monitoring tool to track your credit score.

Then explain where you are what youre trying to purchase and ask why your card was declined. Credit card issuers rarely tell you on the spot that your credit card application was denied. The adverse action letter will give you the specific reason or reasons your credit card application was denied.

Soft inquiries can occur when someone checks your credit for a reason other than approving or denying a credit application such as when you check your own reports or apply for a prequalification or preapproval. Yes a credit card application that an issuer turns down will affect your credit score. However the impact will be no different than what would result if your application gets approved with the sole exception being that your credit wont be further affected by a new trade line also appearing on your major credit reports.

What to do when your credit card gets declined. If you apply and dont accept the offer or your application is declined your credit score is not affected. Credit card applications are declined for many reasons and can be rejected even if you have an excellent credit score.

Most cards will have a contact number on the back of the card. There are no fees including annual late over the limit or other hidden fees you can see your initial credit limit and annual percentage rate apr before you accept your offer. You can check your discover card application status online or call 800 347 3085.

Expect to answer a few security questions to verify your identity. Adequate employment and income. Instead they send a letter an adverse action letter within 7 10 business days of your application that gives more details about the decision.

Also know that a credit check could lead to a soft inquiry rather than a hard inquiry and these never impact your credit scores. Q1 2020 saw a 6 year over year decline in submitted applications and q2 saw a 41 year over year decline.