Online Job From Home Ppp Forgiveness Application Fte Calculation

Online Job From Home Ppp Forgiveness Application Fte Calculation, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Maximizing Your Paycheck Protection Program Ppp Forgivenesshow And Why You Should Keep Your Staff Employed Covid 19 Information Center Vin Amazon Delivery Driver Job Arkansas Fulbright Scholarship Georgia

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness Amazon Delivery Driver Job Arkansas Fulbright Scholarship Georgia

But as mentioned there are now exemptions that allow you to show a lower fte count if you had employees.

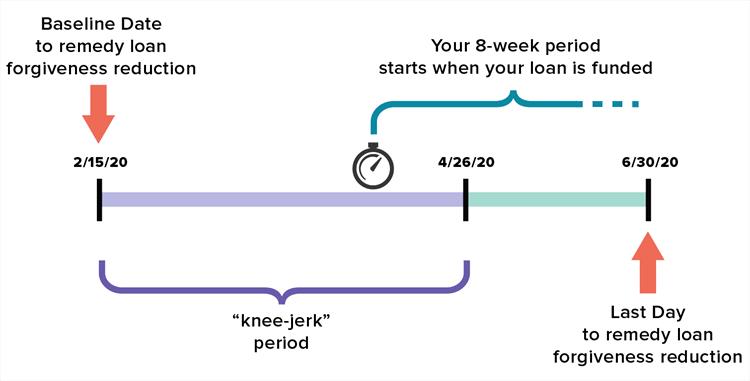

Amazon delivery driver job arkansas fulbright scholarship georgia. Once a loan is secured the next step for many of them will be to determine how to qualify for loan forgiveness. This ratio is referred to as the fte reduction quotient. Ppp loans are forgivable but reductions in employees work hours and total payroll decrease the forgiveness.

In short its a lot to take in. For simplicity when completing the forgiveness application the sba has alternatively allowed you to use 10 for any employee that works more than 40 hours a week and 05 for all other employees. To manage this recipients determine the baseline fte and payroll amounts to calculate the forgiveness.

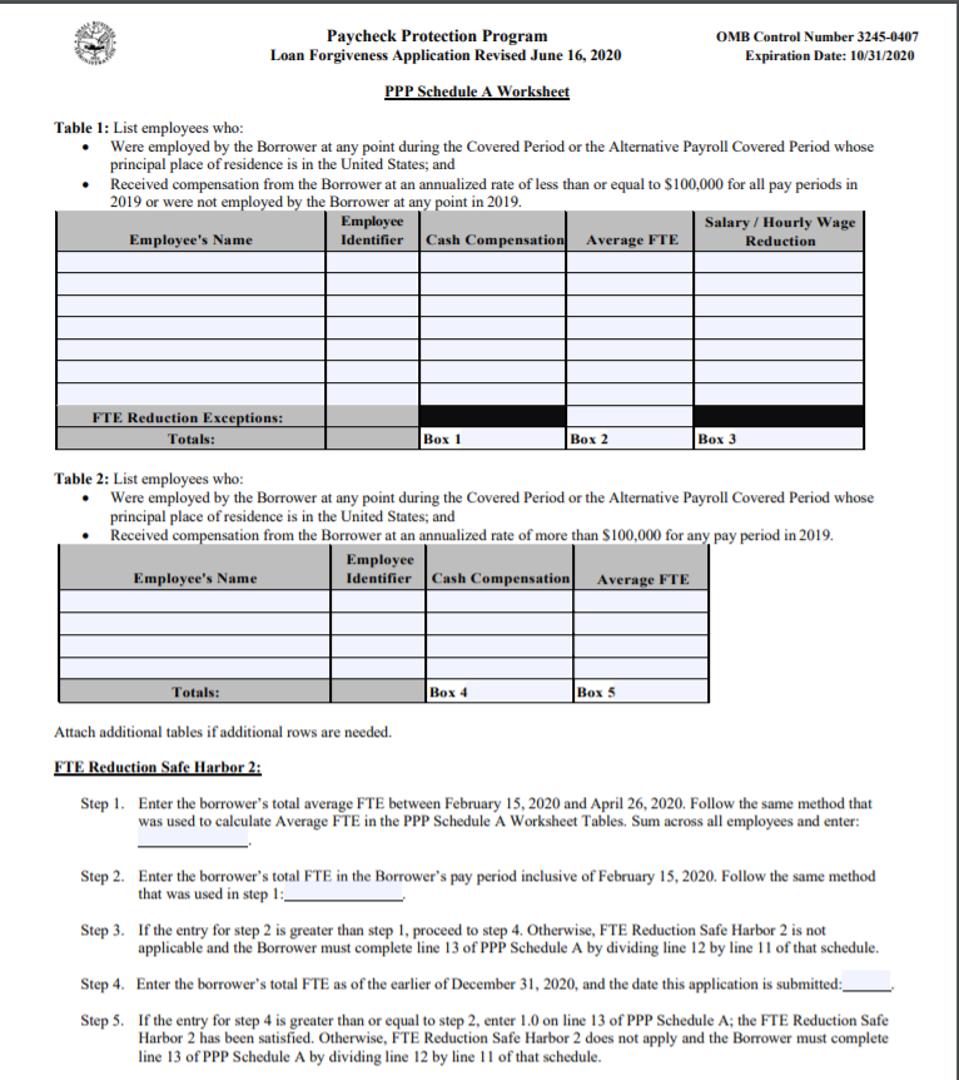

Fte loan forgiveness calculation 2. The fte reduction quotient is multiplied by the total ppp loan amount to arrive at your maximum forgiveness amount. When it comes to ppp forgiveness calculation you need the ppp schedule a worksheet ppp schedule a and ppp loan forgiveness calculation form in that order.

These calculations are used on your ppp loan forgiveness application to prove that you maintained fte employee levels after receiving a ppp loan you can use either calculation on the loan application as long as you remain consistent. Any qualified borrower of a ppp loan of 50000 or less may use sba form 3508s to apply for loan forgiveness and be exempted from any reductions in their loan forgiveness amount based on reductions in full time equivalent fte employees or reductions in employee salary or wages. Borrowers must use all three forms to calculate their loan forgiveness amount.

1 the borrower reduced its fte employee. Each employee that works a 40 hour work or more a week will be counted as 10. Employee 1 40 hours per week.

One thing everyone will need to know is what full time equivalent employees are and how to calculate your fte number. All of these are in the loan forgiveness application form packet. So in that scenario your fte calculations might look like this.

Add your full time fte and your part time fte to get your total fte figure. Under this safe harbor a borrower is exempt from the reduction in loan forgiveness based on fte employees if both of the following conditions are met. This requires the average ftes for the periods.

If you wanted an easier way to calculate fte you could also assign an fte of 10 to all employees that work 40 hours or more per week and an fte of 05 to employees who work less than 40 hours per week.

Ppp Loan Forgiveness Webinar Part Ii Questions Answers Adkf Amazon Delivery Driver Job Arkansas Fulbright Scholarship Georgia