What Is A Very Good Job In Spanish Sba Ppp Loan Forgiveness Excel Spreadsheet

What Is A Very Good Job In Spanish Sba Ppp Loan Forgiveness Excel Spreadsheet, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

The flip side is if we didnt pay since we couldnt deduct the landlord would claim their own ppp.

Job training grcc pua application answers. We have a similar situation and have taken the view that if we have previously deducted those rental expenses then we can claim through forgiveness. The sbas loan forgiveness application provides. If you had a ppp loan prior to the paycheck protection program flexibility act being signed you can choose to use the original 8 week period instead of the 24 week period.

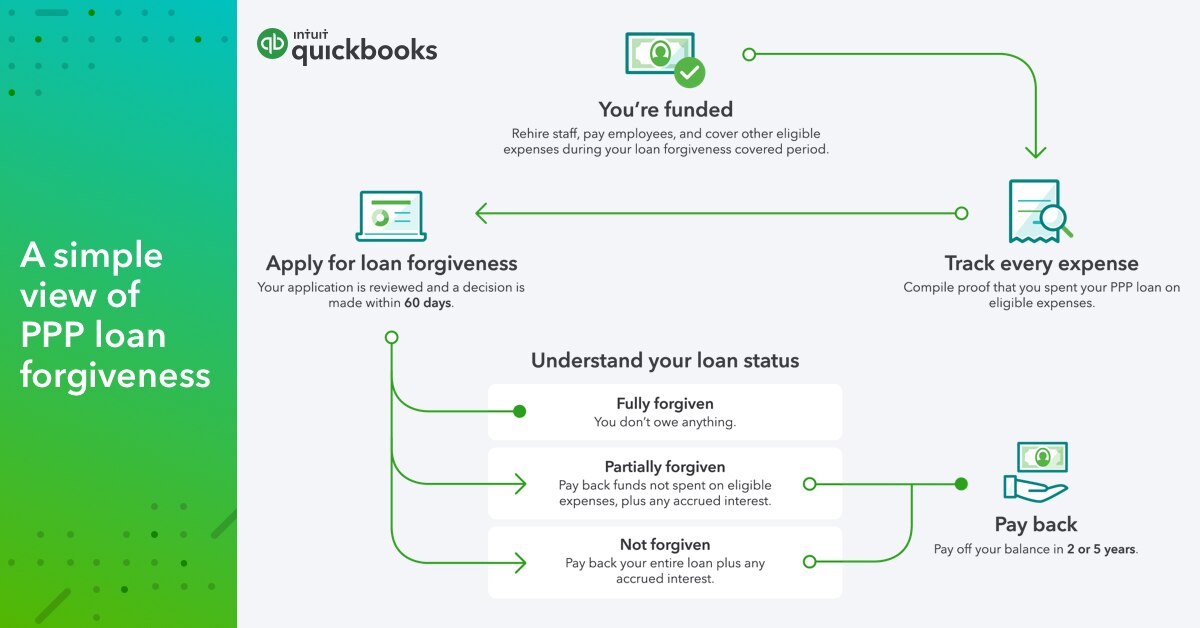

With the release of the new ppp loan forgiveness applications and the passage of the ppp flexibility act the sba continues to include new guidance on how loan forgiveness works and on ppp loans in generalheres whats new. Extension of the forgiveness period. Originally the forgiveness window was eight weeks but under the ppp flexibility act the forgiveness window is.

The lender must defer all payments of principal interest and fees for at least 6 months up to one year. Under the revised process forgiveness for these smaller loans now require less documentation and fewer calculations than the previous process did. Small business administration on thursday announced a new simplified forgiveness application for paycheck protection program loans of 50000 or less.

The sba just issued much awaited guidance allowing borrowers to claim forgiveness of their paycheck protection program ppp loans. An sba loan that helps businesses keep their workforce employed during the coronavirus covid 19 crisis. The unpublished version of the update ensures full forgiveness for self employed freelancers and independent contractors who took the maximum loan amount based on 25 times their 2019 monthly income.

The key will be in the detail. Additional guidance issued by the sba and treasury department after that time may materially impact the loan forgiveness calculations. Enter cash compensation box 1 from ppp.

You can spend ppp funds received on non allowed expenses but know those expenses wont be forgiven you will have to repay them along with loan interest. You will need to fill out a ppp loan forgiveness application form and submit that to your lender. Lets take schedule a line by line.

It doesnt expressly address this. Applications for loan forgiveness will be processed by your lender.