Online Jobs Are Selected In Part Time Employment For Many Ppp Forgiveness Application Self Employed

Online Jobs Are Selected In Part Time Employment For Many Ppp Forgiveness Application Self Employed, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Https Www 1firstbank Com Pr En Documents Summary Sba 7 A Ppp Forgiveness 6 30 Eng Pdf Job Lot Fire Pit Application Software Explanation

The New Ppp Loan Forgiveness Application Early Submission Greenbush Financial Planning Job Lot Fire Pit Application Software Explanation

Lets walk through this application.

Job lot fire pit application software explanation. None of this happens nor does the application even get underway until the sole proprietor files their 2019 1040 schedule c. Documents may include payroll tax filings reported or that will be reported to the irs typically form 941 and state quarterly business and individual employee wage reporting and unemployment insurance tax filings reported or. Three months after the launch of the paycheck protection program ppp many business owners are looking towards their ppp loan forgiveness applicationsthe small business administration sba recently released a new loan forgiveness application along with a simplified ez applicationthough the sba continues to issue updated guidance we finally have most of the information we need to move.

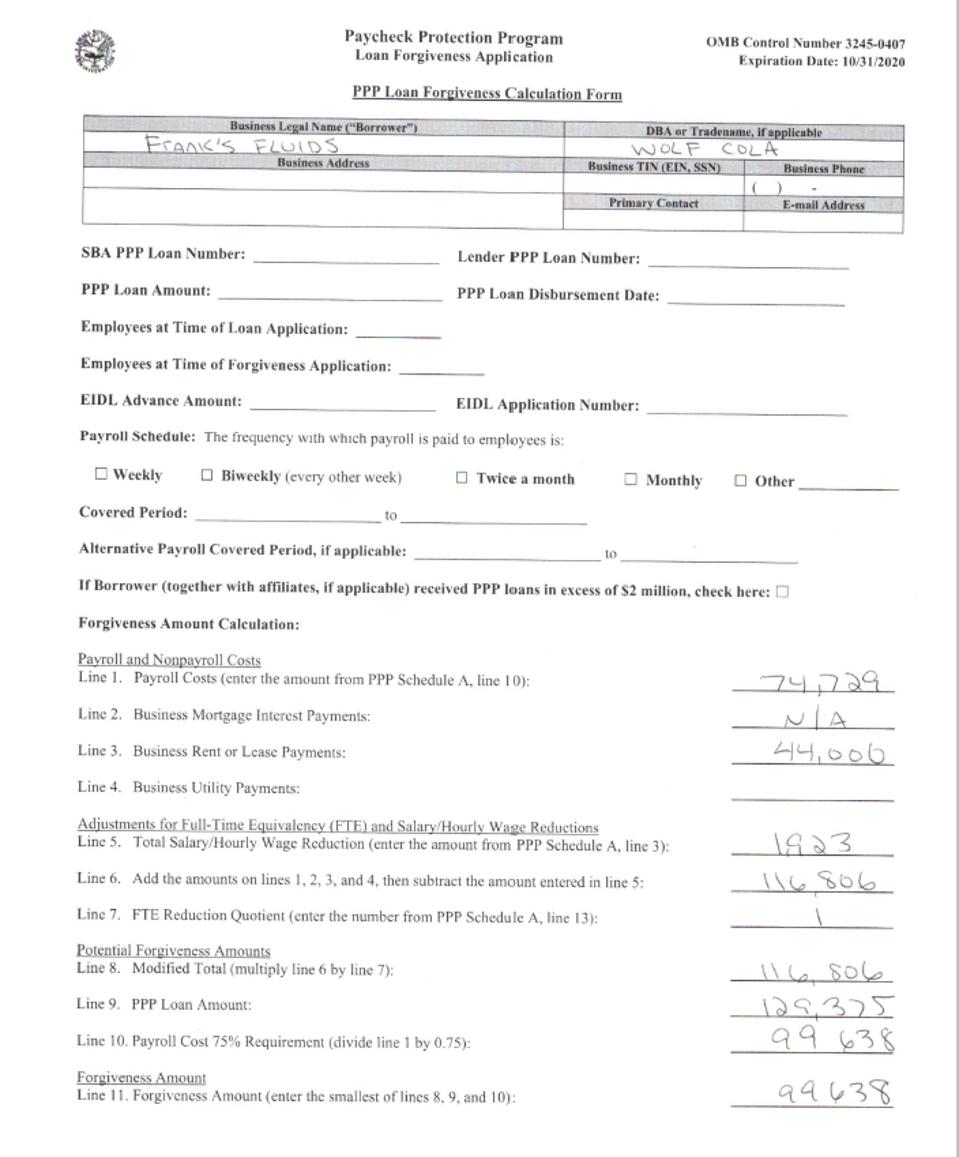

How to complete the ppp loan forgiveness application. The unpublished version of the update ensures full forgiveness for self employed freelancers and independent contractors who took the maximum loan amount based on 25 times their 2019 monthly income. If you have received a paycheck protection program loan you must complete ppp loan forgiveness application if you want your ppp loan to be forgiven.

Be sure to watch for more details on how applying for ppp loan forgiveness will work in the news media from your lender and from the irs andor sba. The mechanics of this part of the ppp program have yet to be formally. The calculation form schedule a and the schedule a worksheet.

The amount of loan forgiveness requested for owner employees and self employed individuals payroll compensation is capped at 25 months worth 2512 of 2019 compensation ie. Get in line as soon as you can if you are seeking the ppp loan and. The application contains three major parts.

Since paycheck protection program ppp applications opened for self employed people on april 10 2020 there have been a number of questions about how the self employed can apply what they need and how to navigate loan forgiveness. The selected time period must be the same time period selected for purposes of completing ppp schedule a line 11. Weve put together some of the most frequently asked questions about ppp loans for the self employed.

The sample application for loan forgiveness came out friday may 15th and while its not as clear as wed all like it provides more guidance than before. Faq clarifies that to qualify for a ppp loan you must have 500 or fewer total employees full and part time.