Online Job United States Ppp Forgiveness Application Where To Submit

Online Job United States Ppp Forgiveness Application Where To Submit, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

10 Takeaways On The Ppp Loan Forgiveness Application Accounting Today Job Search Dubai Credit Card Application Denied

You do not need to wait until the end of the 24 week covered period to apply.

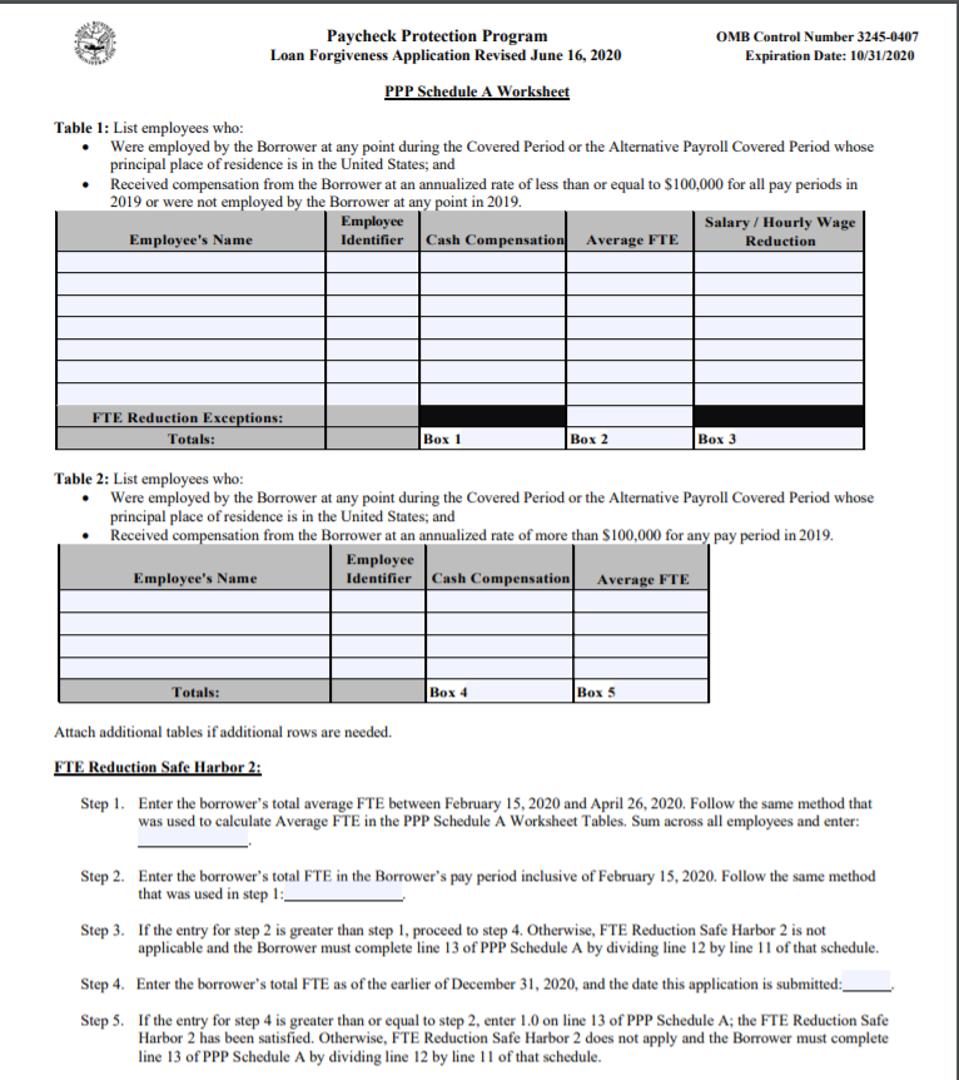

Job search dubai credit card application denied. Application for forgiveness to seek forgiveness a ppp loan borrower may now complete and submit either the updated form 3508 ppp loan forgiveness application standard application or the new form 3508ez ppp loan forgiveness application ez application. 2 ppp schedule a. When the united states federal government announced the paycheck protection program ppp in response to the covid 19 pandemic many small businesses were eager to take advantage of the various loan amounts being offered to help cover payroll costs and other business expenses including business mortgage interest lease payments general interest payments.

How does ppp loan forgiveness work. You have 10 months from the end of your loan forgiveness covered period or from december 31 2020 whichever comes first to apply for forgiveness. For a full list of required information and documentation see the ppp loan forgiveness application.

A borrower may submit a loan forgiveness application before the end of the 8 week or 24 week covered period provided that the borrower has used all of the loan proceeds for which the borrower is requesting forgiveness and the borrowers loan forgiveness application accounts for any salary reductions in excess of 25 percent for the full. Once you have met the criteria for forgiveness you may submit a loan forgiveness application any time between the period starting two weeks after the date of your loan and ending before the maturity date of your loan. Remember accuracy is pivotal when it.

It may be easiest to begin by looking for a payroll report template online or within excel. Once you submit your application for forgiveness your lender has 60 days to accept or deny your application. Creating a ppp payroll report in excel.

1 the ppp loan forgiveness calculation form. The sba has released the new ppp loan forgiveness application form 3508ez which is designed to streamline ppp forgiveness for certain businesses who qualify. While applying for forgiveness may still seem daunting even with this simper form the ez form requires fewer calculations and less documentation for eligible borrowers.

With the paycheck protection program small business borrowers can qualify for forgiveness of up to 100 of the loan if certain guidelines are followedif youve received a ppp loan from pursuit weve outlined the basics and provided links to the relevant sba final interim rules these are documents that lay out the nuts and bolts of the program in our ppp loan forgiveness guide. You can also submit your application before the end of your covered period whether its eight or 24 weeks but theres a good reason you may not want to do so. If you run payroll manually you might create a payroll report in excel.

Submit it to your lender or the lender that is servicing your loan. Thats regardless of when you submit your loan forgiveness application. Borrowers may also complete this application electronically through their lender.