Online Job Quiz Ppp Forgiveness Application Schedule A

Online Job Quiz Ppp Forgiveness Application Schedule A, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

- Job Hiring Online Job Amazon Application Kenosha Wi

- Part Time Job For International Students In Netherlands Medical Application Cycle

- How To Get A Job Coding Common Application Blog

- Find A Job During Lockdown Food Stamp Application Hot Springs Ar

- How To Get A Job Real Estate Common Application Portal

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Fill Out The Ppp Ez Forgiveness Application In 7 Steps Finder Com How To Get A Job Real Estate Common Application Portal

A Huge Tax Bill Is The Downside Of Student Loan Forgiveness Student Loan Planner How To Get A Job Real Estate Common Application Portal

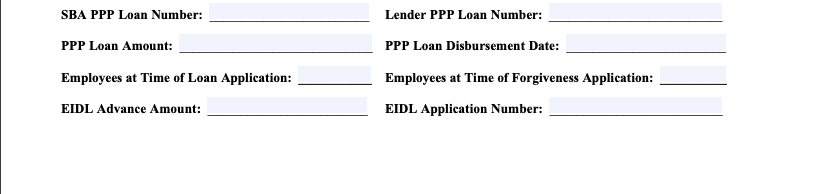

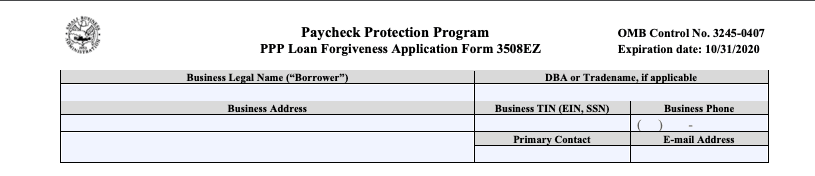

As you prepare to start your forgiveness.

How to get a job real estate common application portal. Please click here for guidance regarding the ppp loan eligibility and forgiveness provisions for those with schedule c income. Our team is working with integrality a small business firm to gather and process your documentation using this secure portal. And they have filed or will file a 2019 form 1040 with a schedule c.

Your loan forgiveness will also be reduced if you decrease salaries and wages by more than 25 for any employee that made less than 100000 annualized in 2019. Some items to note. Applying for ppp loan forgiveness is tricky.

I understand that loan forgiveness will be provided for the sum of documented payroll costs covered mortgage interest payments covered rent payments and covered utilities and not more than 25 of the forgiven amount may be for non payroll costs. Some lenders might ask you to fill out the sbas application directly while others might ask you to fill out an online form on their website. A key component of the ppp loan forgiveness is restoring your work force.

Calculate your forgiveness amount with the ppp schedule a worksheet. These year end tax planning strategies address recent tax law changes enacted to help taxpayers deal with the pandemic such as tax credits for sick leave and family leave and new rules for retirement plan distributions as well as techniques for putting your clients in the best possible tax position. Your loan forgiveness will be reduced if you decrease your full time employee headcount.

We recently hosted a session on the ppp forgiveness application watch the webinar recording here. To fill out your application correctly make sure that you understand covered periods fte and schedule a. 2 fte job reduction that.

1 non payroll expense tracking including mortgage payments rent and utilities. Get your clients ready for tax season. Schedule c filers who were in business as of 2152020 with se income are eligible for a ppp loan if their principle place of residence is the us.

While you dont have to submit the schedule a worksheet youre still required to have this it on record. Be sure to carefully review the instructions included with the application to complete the schedule a worksheet to determine whether there will be a reduction in the loan forgiveness amount based upon a reduction in the number of full time equivalent employees ftes. Hello liftfund ppp client we are ready to accept your ppp loan forgiveness application.