Online Job Legit Ppp Loan Forgiveness Application Deadline 10 Months

Online Job Legit Ppp Loan Forgiveness Application Deadline 10 Months, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Ppp loan recipients may apply for forgiveness at any time post loan funding and prior to loan maturity to receive forgiveness for expenses that were incurred during the 24 week period after loan disbursement or first day of the first pay period post loan funding for those using the alternative covered period.

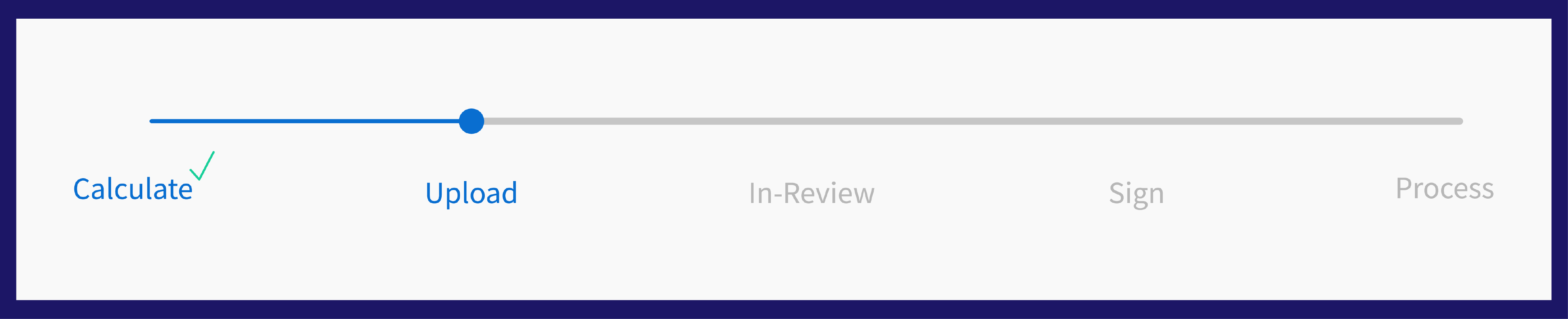

Amazon job jalgaon social security application locations. We have launched our online ppp forgiveness application form and have started to roll it out to customers. If you apply for forgiveness within 10 months of your 24 week covered period your loan payments may. Paycheck protection program loan forgiveness application revised june 16 2020 omb control number 3245 0407 expiration date.

In the coming weeks you will receive an email from us about how to access our online application. Borrowers must apply for forgiveness within 10 months of their forgiveness covered period which could run well into 2021. The loan forgiveness application currently has an expiration date of october 31 2020.

The law also drops the required payroll expenditure amount from 75 to 60. Borrowers who obtain ppp loan forgiveness are now allowed to delay payment of employer payroll taxes. Ppp loan forgiveness checklist.

Please note if ppp loan. Ppp loan forgiveness calculation form business legal name borrower dba or tradename if applicable business address business tin ein ssn business phone primary contact e mail address. If your business received a ppp and didnt lay off employees or reduce salaries may be eligible to fill out a simplified forgiveness application.

The deadline to apply for loan forgiveness has been extended to ten 10 months following the covered period approved uses business owners can now spend up to 40 of ppp loan proceeds on mortgage interest rent utilities and are only required to spend at least 60 of ppp loan proceeds on payroll costs. If you received a ppp loan in may 2020 and elect a 24 week forgiveness period you should apply for forgiveness no later than august 2021 to avoid debt payments. When submitting a ppp application all borrowers must certify in good faith that current economic uncertainty makes this loan request necessary to support the ongoing operations of the business.