Jobs In Spanish Vocab Sba Ppp Loan Forgiveness 8 Weeks Vs 24 Weeks

Jobs In Spanish Vocab Sba Ppp Loan Forgiveness 8 Weeks Vs 24 Weeks, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

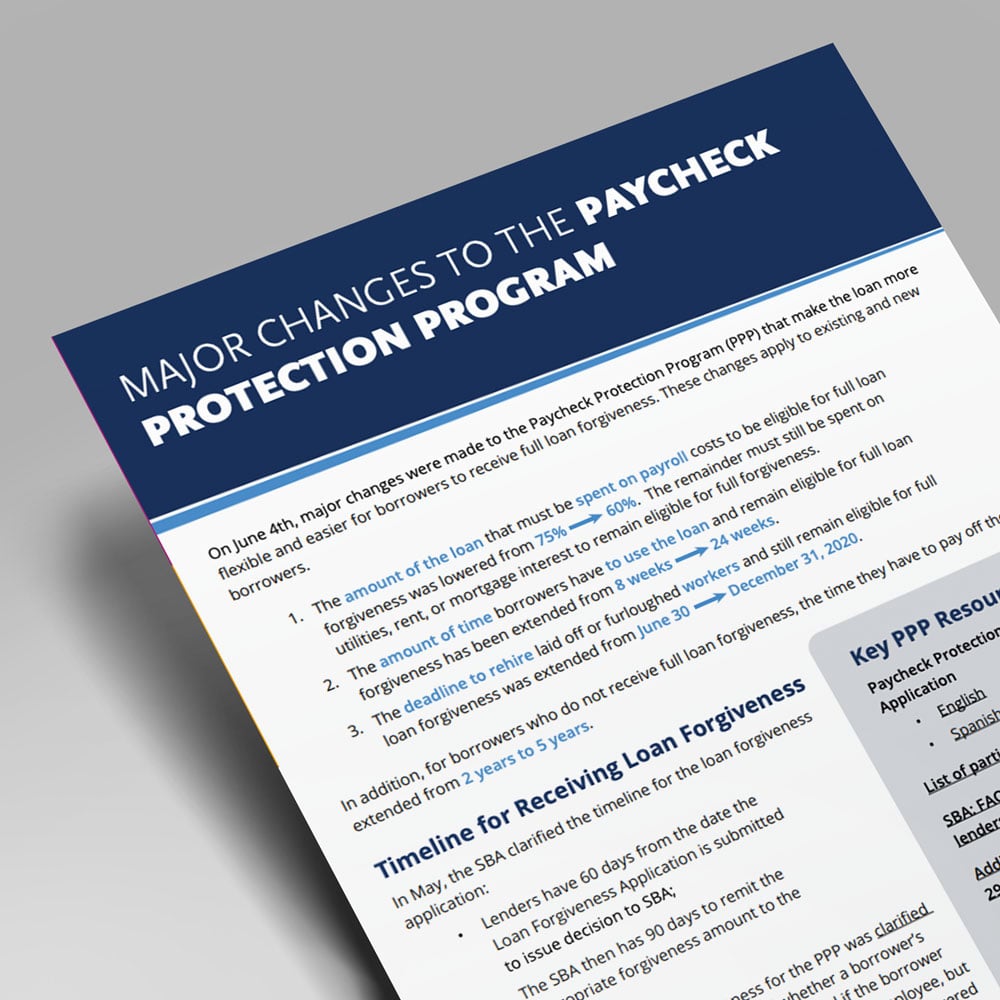

An Updated Guide To Applying For Ppp Loan Forgiveness With Changes From The Ppp Flexibility Act Manatt Phelps Phillips Llp Jobs Near Me Volunteer Unemployment Application Status Ny

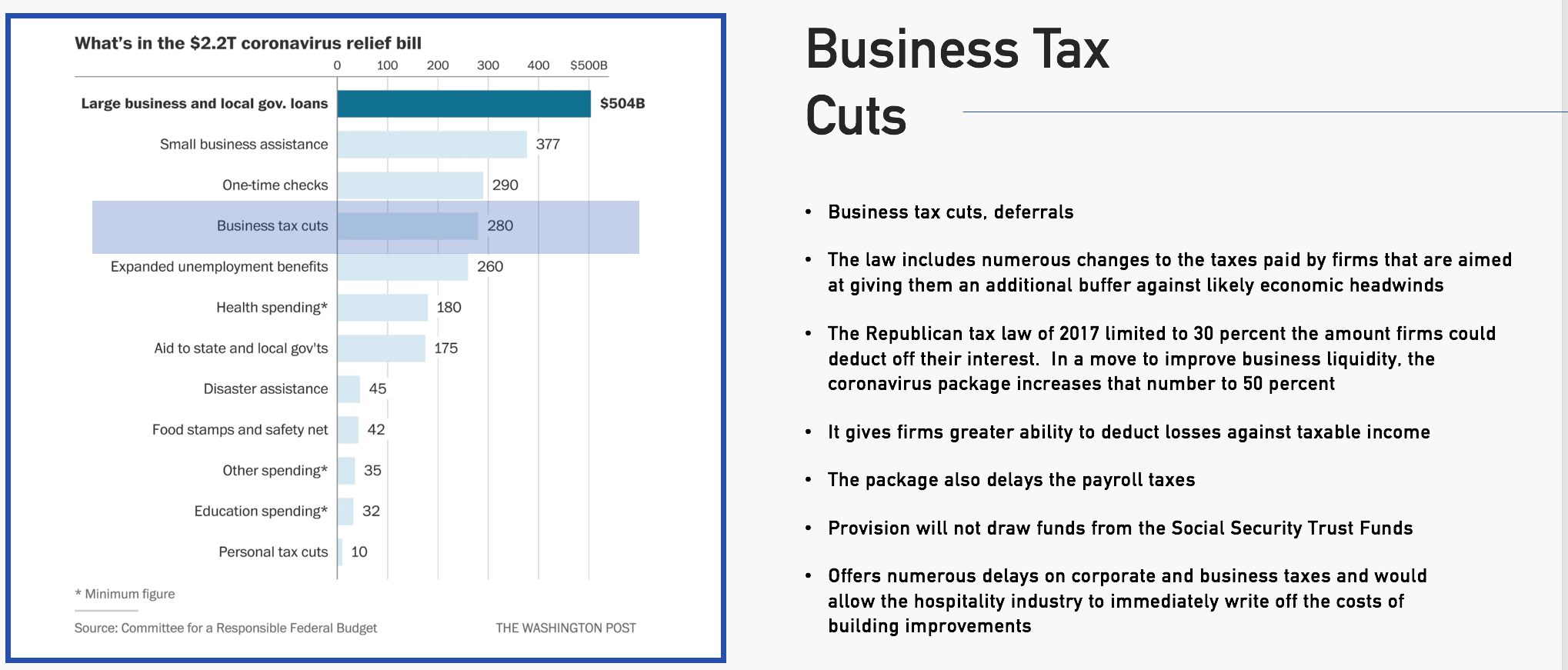

Covid 19 Disaster Resources Ascension Economic Development Corporation Jobs Near Me Volunteer Unemployment Application Status Ny

Time to pay off the loan has been extended to five years instead of 2.

Jobs near me volunteer unemployment application status ny. February 15 2019 to june 30 2019 19 weeks or january 1 2020 to february 29 2020 8 weeks. The number of ftes who work during the 24 week loan window and the number of ftes who work during one of the following baseline periods whichever is lower. This tool has been prepared using the cares act the sbas paycheck protection program loan forgiveness application the ppp flexibility act of 2020 as well as any other relevant guidance available as of july 7 2020.

The sba form 3508 requires that a borrower who along with its affiliates received aggregate ppp funds over 2 million check a box alerting the sba to the size of the aggregate loan. Over the 24 weeks of the ppp period you spend 36000 on your employees more than your ppp loan amount. Extending the time a borrower can qualify for the fte and salary wage reduction safe harbors.

But now instead of 10000052 8 a max of 15385 per individual you get up to 10000052 24 making the new maximum forgiveness cap 46154 per individual for 24 weeks. The 8 week now 24 week for new ppp loans as of june 5 2020 period for your loan and consequently your loan forgiveness starts at the time when you receive the money from your ppp loan. You claim the full 22500 of your loan for forgiveness.

An sba loan that helps businesses keep their workforce employed during the coronavirus covid 19 crisis. If we assume you do not qualify for any rehiring exemptions when it comes to calculating your forgivable amount because your workforce is smaller your forgivable amount will be. Sba will forgive payments of principal and interest on a loan amount equal to what you spend on certain costs for eight weeks from the date of your loan including.

As of june 5 2020 a new bill was signed into law by the president to expand the ppp loan forgiveness rules. Reduces mandatory payroll spending from 75 to 60. We are happy to provide you with this robust planning tool for loan forgiveness.

Any reduction in loan forgiveness needs to be based on the difference between two numbers. Borrowers now have 24 weeks to spend ppp loan proceeds up from 8 weeks.

A Ppp Dilemma Can Employers Exclude Employees Who Refuse To Return To Work From Their Loan Forgiveness Calculation Littler Mendelson P C Jobs Near Me Volunteer Unemployment Application Status Ny

More From Jobs Near Me Volunteer Unemployment Application Status Ny

- Online Job Reviewing Websites Ppp Forgiveness Application Tutorial

- Good Job In Spanish Wordreference Sba Ppp Loan Forgiveness Timeline

- Good Job Done In Spanish Sba Ppp Loan Forgiveness Guidance Sole Proprietor

- Job Search Jobactive Credit Card Apply Japan

- Job Search Melbourne Australia Credit Card Application Maybank