Jobs In Spanish Vancouver Sba Ppp Loan Forgiveness Calculation Worksheet

Jobs In Spanish Vancouver Sba Ppp Loan Forgiveness Calculation Worksheet, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

- Job Fair Questions Employers Ask Food Stamps Application Raleigh Nc

- Job Resume With Experience Medicaid Application Status Withdrawn

- Find A Part Time Job In New Zealand Absentee Ballot Application For Presidential Election

- Job Search Visa Netherlands Credit Card Apply Visa

- Job Search Jobactive Credit Card Apply Japan

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

How The Cares Act Sba Loan Forgiveness Works National Restaurant Association Job Search Jobactive Credit Card Apply Japan

The forgiveness application provides the sbas initial perspective on the qualifications.

Job search jobactive credit card apply japan. Separate and apart from the question of whether the borrower qualifies for forgiveness the sbas interim rule actually imposes. Last updated june 8 2020. On may 15 2020 the small business administration released the loan forgiveness application for the paycheck protection program the application.

Ppp loan forgiveness workbook faqs 77 ppp loan forgiveness workbook updated instructional video 77 ppp loan forgiveness workbook updated case study 617 loan forgiveness ez application pdf and instructions 617 loan forgiveness application pdf and instructions. The sba not later than 90 days after the lender issues its decision to sba and subject to any sba review of the loan or loan application will remit the appropriate forgiveness amount to the ppp lender plus any interest accrued through the date of payment but deducting any eidl advance if applicable note. On june 5 2020 the paycheck protection program flexibility act of 2020 was signed into law that will among other things extend the time period allowed for businesses to spend ppp loan proceeds and ease restrictions on eligible forgivable expenses.

The sba has stated that it will. The cash grant is yours to spend even if you dont qualify for the eidl loan but it will reduce any forgiveness benefits you receive from a ppp loan. The optional ppp borrower demographic information form.

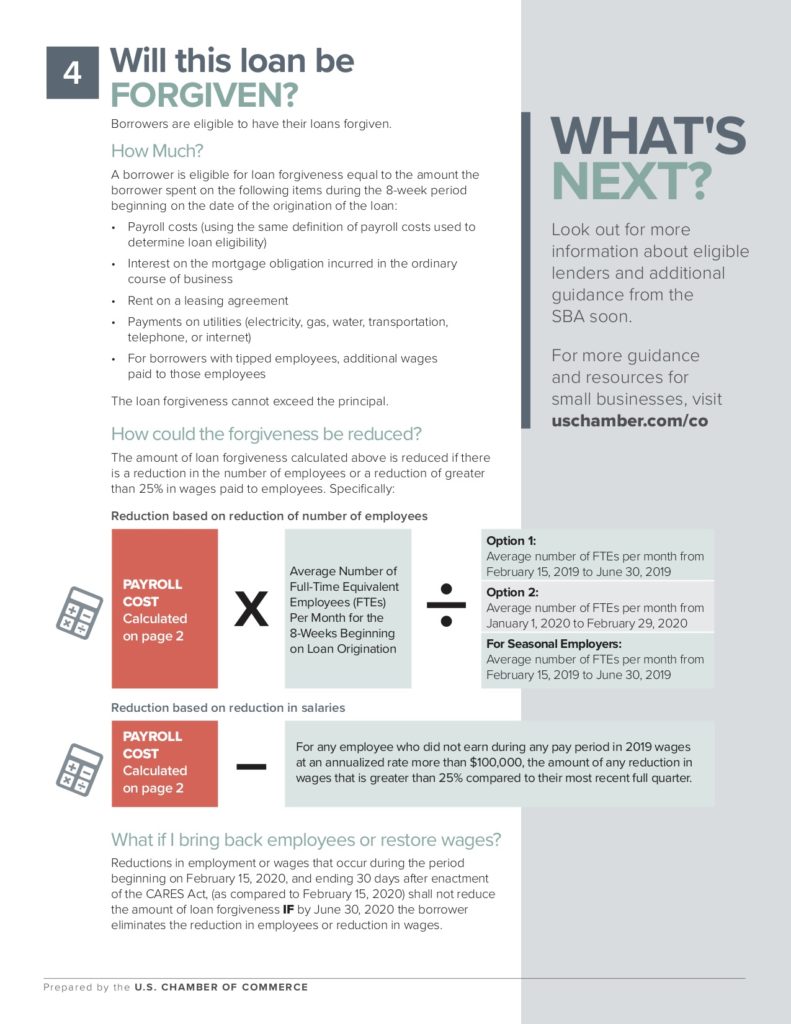

At least 75 percent of the ppp loan. The sba form 3508 requires that a borrower who along with its affiliates received aggregate ppp funds over 2 million check a box alerting the sba to the size of the aggregate loan. Review updates from sba and treasury from may 15 2020 and may.

The application is comprised of four components. It has been prepared using the cares act the sbas paycheck protection program loan forgiveness application the ppp flexibility act of 2020 as well as any other relevant guidance available as of july 7 2020. The ppp schedule a worksheet.

Additional guidance issued by the sba and treasury department after that time may materially impact the loan forgiveness calculations. The ppp loan forgiveness calculation form. Sba will forgive payments of principal and interest on a loan amount equal to what you spend on certain costs for eight weeks from the date of your loan including.