Job Opportunities Real Estate Ppp Loan Application In Chase

Job Opportunities Real Estate Ppp Loan Application In Chase, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Last week the treasury updated its faqs to let us know that borrowers with loans below 2 million would be presumed to have taken the loan in good.

Job indeed vaughan medicaid share of cost. Whoever processes your application first will receive an sba approval number for your business if you qualify for the loan. It isnt possible to understand if the intention of the treasury was to exclude the types of real estate firms described below or if they simply hadnt considered that many of these firms do have employees. Ppp loans in excess of 2 million check box.

2020 that smaller financial institutions would have an exclusive window of time to submit their clients loan applications. Bank and investment statements from the last 3 months. Conventional or sba financing.

Ppp loans are intended to provide up to. Loans start at 50000. Real estate management companies are not considered passive and are therefore eligible for ppp.

These applications will be made available via online platform provided by your bank ie. The sba will only issue one plp for each tax id meaning there is no chance you will accidentally get approved for two ppp loans. Your home purchase contract signed by you and the seller.

W 2 forms showing the last 2 years of your employment. A completed and signed form 4506 t or 4506t ez. Roughly half of the applications were filed by businesses with fewer than.

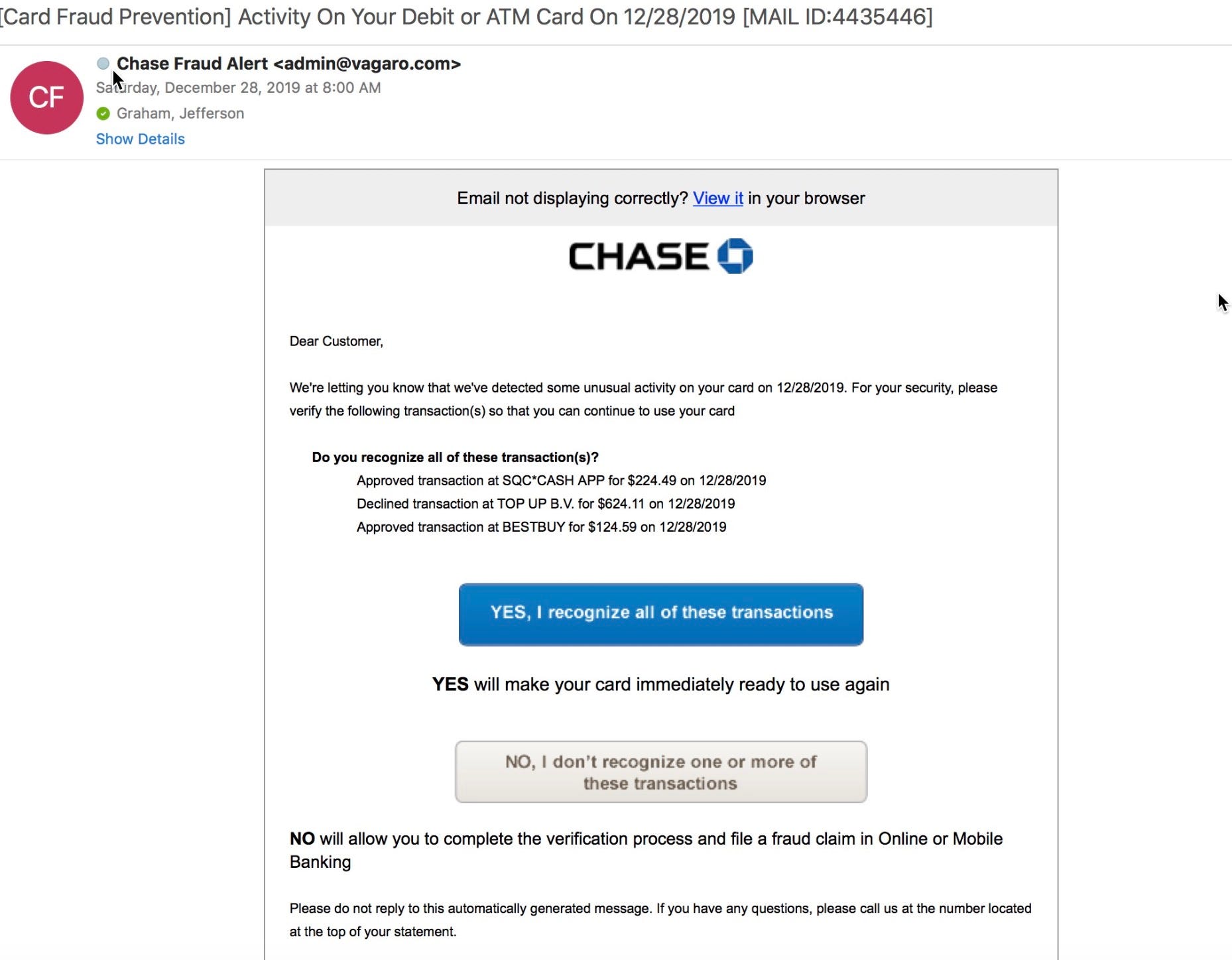

Use this mortgage application document checklist to make sure you arent missing any important information. It is completely possible and likely that some banks. If you do your business banking at chase you are only eligible to apply through chases portal and you must have had a business checking account with chase prior to february 15 2020 to qualify.

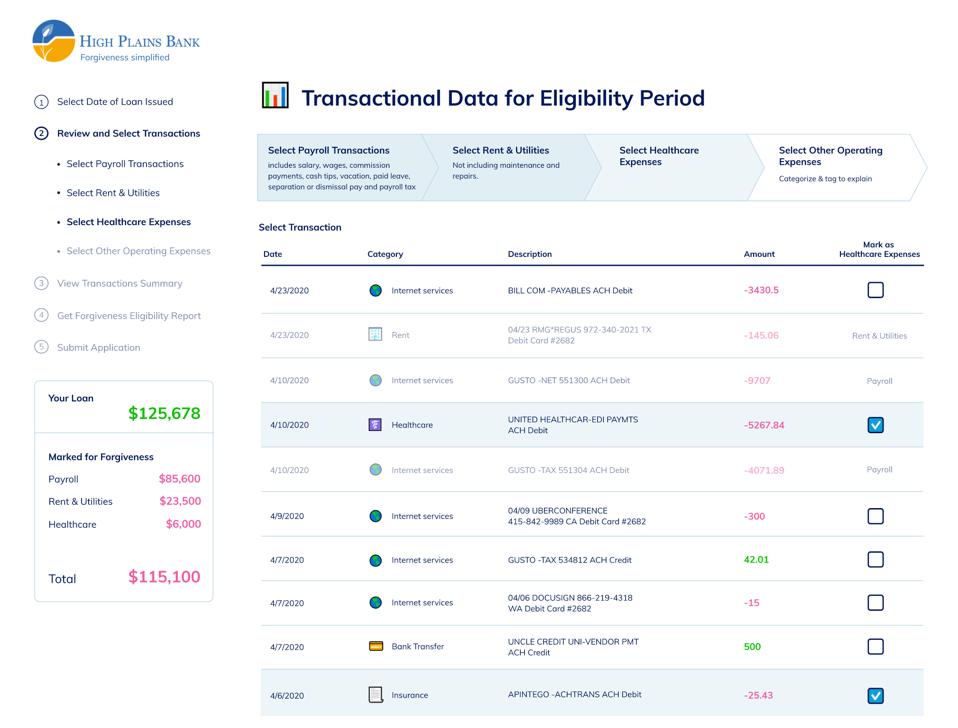

Construction loans available with interest only payments during construction period followed by a fully amortized term out period. The amount of the ppp loan eligible for forgiveness is the amount expended by the business during the eight week period after the start date of the ppp loan on i payroll costs and ii to the extent the arrangements were in place prior to february 15 2020 mortgage interest payments lease payments and utility payments. Chase allegedly processed ppp loans for these clients resulting in an inability to lend to smaller businesses by the time the initial round of ppp funding.

Up to 80 loan to value ratio for most owner occupied commercial real estate.

How To Apply For The Sba Payroll Protection Program Loan Simple Guide Job Indeed Vaughan Medicaid Share Of Cost

/cdn.vox-cdn.com/uploads/chorus_asset/file/20069957/1223644136.jpg.jpg)