Job Opportunities Program Ppp Loan Application Guidelines

Job Opportunities Program Ppp Loan Application Guidelines, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

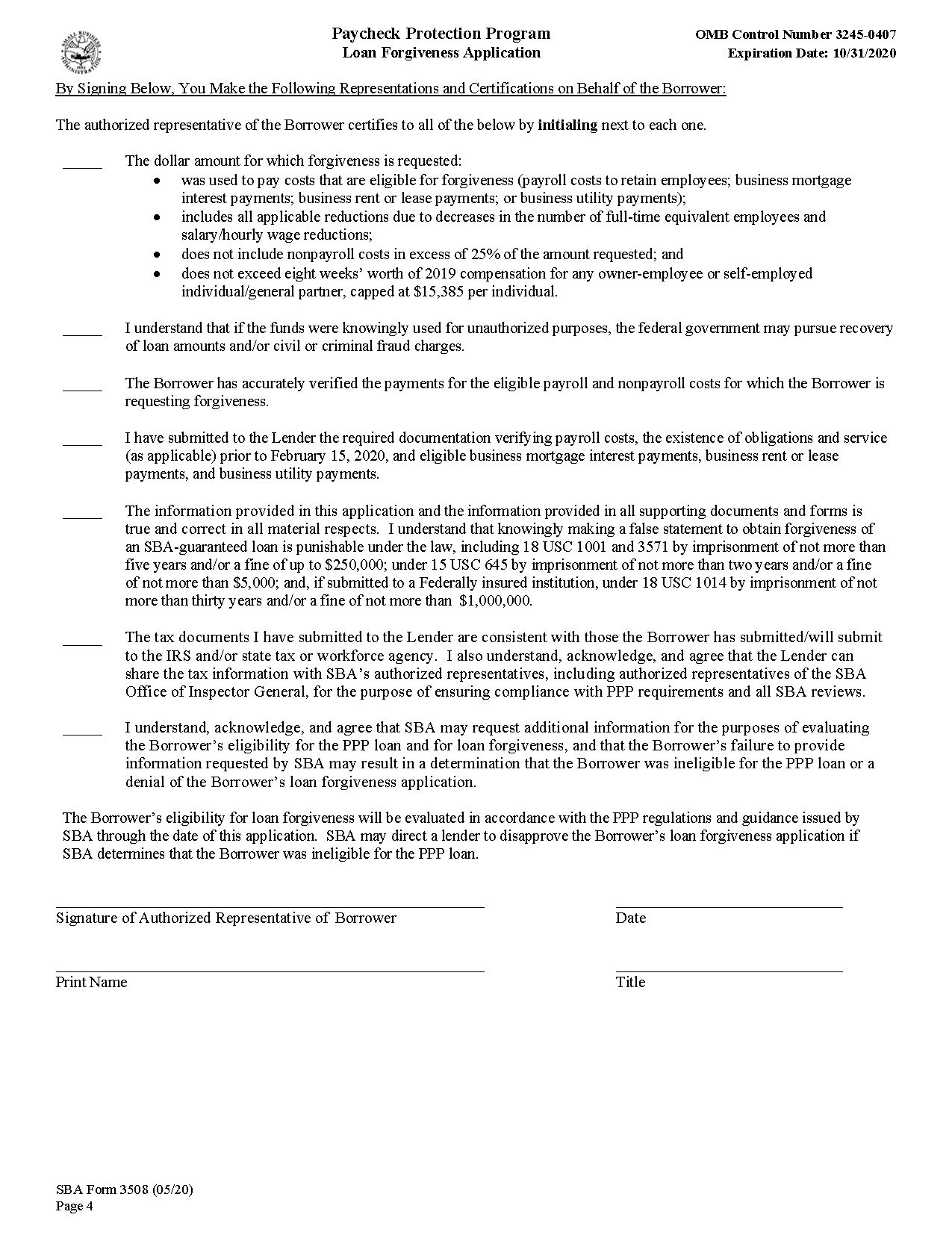

Treasury Department And Sba Release Ppp Forgiveness Application Form Narfa Part Time Job Linkedin Medical Application In California

Paycheck Protection Program Deadline Is June 30 What To Know About Applying For The Ppp And Loan Forgiveness Part Time Job Linkedin Medical Application In California

Instead the self employment income of general active partners may be reported as a payroll cost up to 100000 annualized on a ppp loan application.

Part time job linkedin medical application in california. If you were one of the millions of businesses approved for sba paycheck protection program ppp loans your next step is applying for loan forgiveness. The sba clarifies that while partnerships are eligible for ppp loans a partner in a partnership may not submit a separate ppp loan application for themselves as a self employed individual. The alabama sbdc will host a webinar on monday may 18 at 3pm to review the application and guidelines.

Although ppp loans come with the most attractive business loan terms most of us will ever see in our lifetimes 1 for 2 years you will probably want to make sure you take the proper steps to ensure that a future ppp loan or a current loan if you made it through the first round is forgiven. All loan terms will be the same for everyone. The ppp loan program restarted following the appropriation of new funding on friday april 24 2020.

The paycheck protection program ppp authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the covid 19 crisis. By business and employment lawyer matthew mitchell morse law firm waltham boston cambridge ma. The supplemental interim final rule second rule to the paycheck protection program has important implications for llcs filing taxes as a partnership and partnerships that have applied or are considering applying for ppp loans.

Future ppp loan forgiveness should be top of mind when you apply. On friday 515 sba released a loan forgiveness application that is designed to educate borrowers on how to apply for ppp loan forgiveness. The sba is no longer accepting applications for ppp loans.

Additional guidance for both borrowers and lenders is still expected from the agency. The application includes a worksheet that details how to. Ppp loans are available for the lesser of 10 million or 25 times your average monthly payroll.

The loan amounts will be forgiven as long as. If you received a ppp loan through kabbage sign into your dashboard for updates on loan forgiveness. Loan forgiveness is available if you spend 75 of the loan proceeds on payroll costs and 25 on mortgage rent and utilities.

A provision of the cares act the paycheck protection program ppp is a payroll assistance option that provides small businesses with a forgivable sba backed loan to cover 8 weeks of payroll and some operating expenses during the covid 19 pandemic. Ppp update for llcs and partnerships. Ppp loan applications for sole proprietors and independent contractors start april 10 2020.

The loan proceeds are used to cover payroll costs and most mortgage interest rent and. You can borrow 25 times your average monthly payroll costs payroll costs are defined as net earnings from self employment.

Treasury Department Issues Guidance And Application For Paycheck Protection Program Loans Government Contracts Insights Part Time Job Linkedin Medical Application In California