Job Opportunities Overseas Ppp Loan Application Eligibility

Job Opportunities Overseas Ppp Loan Application Eligibility, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Foreign Affiliates And The Small Business Size Standards For Ppp Loan Eligibility Avoiding Fca Liability For False Certifications News Insights Hispanicbusinesstv How To Get A Job Without A Degree Common Application Updates

Cares Act Understanding Sba S Loan Eligibility Requirements Including Affiliation Rules Baker Donelson Jdsupra How To Get A Job Without A Degree Common Application Updates

For your ppp application youll need to submit a schedule c not your 1099s.

How to get a job without a degree common application updates. Ppp loans are available for the lesser of 10 million or 25 times your average monthly payroll. By business and employment lawyer matthew mitchell morse law firm waltham boston cambridge ma. Subsidiary of a foreign owned company may qualify for cares act loan programs.

Independent contractors who collect 1099 misc forms. As part of its new guidance the sba appears to have answered the question directly. An sba loan that helps businesses keep their workforce employed during the coronavirus covid 19 crisis.

Recently published faqs provide additional clarity that foreign owned companies may want to consider even if their loan application was already rejected. Ppp update for llcs and partnerships. All small businesses qualify for the payment protection program including.

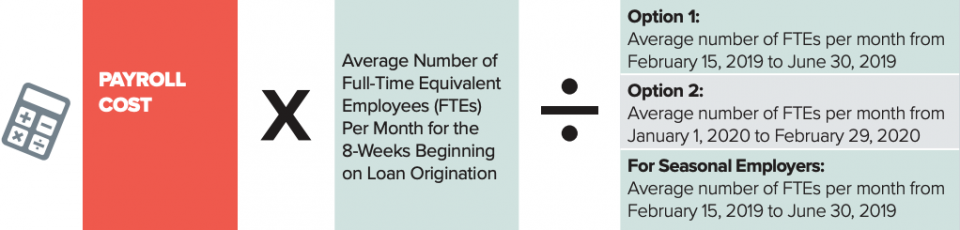

Sba is providing businesses who already received loans an opportunity to reassess their eligibility for the ppp loan in light of the new guidance. Sole proprietors who report income and pay taxes on a schedule c in your personal tax return. The paycheck protection program ppp is designed to support american small businesses with eight weeks of cash support during the covid 19 pandemic.

The ppp loan program restarted following the appropriation of new funding on friday april 24 2020. If you are a partner in a multi member llc or partnership heres what you need to know about the ppp and what youll need to apply. Any business that applied for a ppp loan prior to the issuance of the supplemental sba guidance which was published on april 23 2020 and repays the loan in full by may 7 2020 will be deemed by.

The sba clarifies that while partnerships are eligible for ppp loans a partner in a partnership may not submit a separate ppp loan application for themselves as a self employed individual. On june 5 2020 president donald trump signed a law modifying key provisions of the paycheck protection program ppp one of the highest profile coronavirus related financial aid and stimulus measures passed by the united states congress in the opening months of the covid 19 pandemic. The supplemental interim final rule second rule to the paycheck protection program has important implications for llcs filing taxes as a partnership and partnerships that have applied or are considering applying for ppp loans.

The historical sba affiliation rules do not necessarily apply to ppp and other cares act loan eligibility.

The Paycheck Protection Program Ppp What We Know Where To Apply Part Time Money How To Get A Job Without A Degree Common Application Updates