Job Opportunities In Xseed Ppp Loan Application Quickbooks

Job Opportunities In Xseed Ppp Loan Application Quickbooks, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

- Job Application Letter Kelas 12 Passport Application Sign In

- Jobs In Spanish Fork Utah Sba Ppp Loan Forgiveness Form 3508ez Instructions

- Job Openings Vs Job Seekers Walmart Application Cart Pusher

- Job Fair X Reviews Food Stamps Policy

- How To Get A Job At Koala Cafe Roblox Common Application Information

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Quickbooks Services Business Accounting Longschaefer How To Get A Job At Koala Cafe Roblox Common Application Information

After providing average monthly payroll and number of employees fundera will contact you with loan options.

How to get a job at koala cafe roblox common application information. Learn how you can prepare for paycheck protection program ppp loan forgiveness. Read our in depth review. If the thought of applying for a ppp loan is overwhelming consider working with fundera.

The sba released the official ppp loan forgiveness application on may 15 2020. The small business administration sba and the us. For instance mortgage interest payments rent payments and utility payments may be eligible provided those were all set up before february 15 2020.

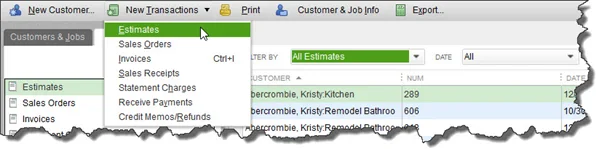

Get started with fundera. Below are steps for recording paycheck protection program ppp funds and expenses in quickbooks online. Quickbooks capital is not able to process applications from schedule c filers who have employees seasonal businesses or recipients of an eidl.

Are you eligible for a ppp loan. Your loan and forgiveness are capped at 19240 92350 12 x 25. In the initial application just pick something and go with it.

Form 1040 schedule c businesses. The loan will be totally forgiven provided workers remain in employment for the 8 weeks after the loan is given at least 75 of headcount and may still be partially forgiven as you drop below that amount. With the onset of the covid 19 virus and the shutdown of the worldwide economy congress authorized economic injury disaster loans eidl and paycheck protection program loans.

Your corporation has 92350 in qualifying payroll costs. If you use another accounting system youll need to alter these steps accordingly. The ppp ends on june 30 and quickbooks capital does not guarantee that your loan application will be reviewed processed presented for sba approval or receive sba approval before the ppp ends.

Should you apply for the loan. As the filing deadline for taxes has been extended into the summer many business owners have not yet processed their 2019 taxes and are being directed to instead use this official document called the payroll processor record or also being called the cares sba ppp report which needs to be sourced from an official source like quickbooks. To recap ppp loans are designed to help small business owners cover their payroll costs and certain operating expenses.

Let the bank tell you. The paycheck protection program flexibility act ppp flex act was signed into law on june 5 2020. Department of the treasury authorized paycheck protection program ppp loans to help small businesses pay employees and cover expenses.

This is just an application. If your company or client received a ppp loan some or all of the loan. Loans can be used on other expenses as well.

Recipients of a ppp loan may. Setup the ppp loan account on the chart of accounts this loan is a liability until it is determined how much of the loan will be forgiven. The experts at fundera have an easy application process for ppp loans.

Intuit Quickbooks Posts Facebook How To Get A Job At Koala Cafe Roblox Common Application Information